Carbon Capture, Utilisation and Storage

Russia's War on Ukraine Light Well

Understand and manipulate data with easy to use explorers and trackers

Free and paid data sets from across the energy system available for download

Past, existing or planned government policies and measures

Access every chart published across all IEA reports and analysis

Create a free IEA account to download our reports or subcribe to a paid service.

Lighting is a major source of energy demand, though it is one area where energy use has stalled or even declined, thanks to new more-efficient options. LEDs are shaping current market dynamics, and competition among manufacturers is driving further innovation, wider product choices and lower prices.

Numerous countries began to phase out incandescent lamps more than ten years ago and many are now beginning to eliminate fluorescent lighting. Half of the global residential lighting market now uses LED technology.

Although some advanced markets have introduced new regulations mandating the exclusive sale of high-efficacy LED lamps, progress in this area must be sustained to ensure that all countries sell predominantly LED technology by 2025, and with increasing efficiency to 2030, to align with the Net Zero Emissions by 2050 Scenario.

Electricity consumption for lighting increased in 2022, with greater efficiency not offsetting increased use of lighting. Despite the falling carbon intensity of electricity, CO2 emissions from lighting rose slightly in 2022.

2022 saw continued progress both in the deployment of light-emitting diodes (LEDs) and in lighting efficiency. While numerous countries began to phase out incandescent lamps more than ten years ago, many are now beginning to eliminate fluorescent lighting as well to make LEDs the dominant lighting technology. About 50% of global residential lighting sales use LED technology.

To align with the Net Zero Emissions by 2050 Scenario, progress in this area must be sustained to 2030 to ensure that all countries sell predominantly LED technology and with increasing efficiency.

Prominent progress in increasing standards and labels for lighting

Countries and regions making notable progress in shifting lighting towards the best available technology include:

CO2 emissions by lighting increased marginally in 2022, despite increased uptake of efficient lamps

In 2022, emissions in the lighting sector rose marginally along with the wider Covid-related rebound that started in 2021. The emissions intensity of electricity, an important factor for CO2 emissions, fell too little to offset increased lighting demand.

To stay on track with the Net Zero by 2050 Scenario, a continued effort on increasing LED lighting is needed, along with continued decarbonisation of electricity generation. Emissions must fall by around two-thirds to 2030. Prioritising the phasing out of older technologies by improving efficacy (how much light per unit of energy, usually in lumens per Watt), and quality (such as the lifetime) of new lamps, will be key to achieving this objective.

Increased energy demand for service lighting more than offset a drop in residential lighting in 2022

Despite continued improvements in the efficacy of lighting, increasing use of lighting drove up total energy consumption in 2022, particularly in large emerging economies. To stay on track with the Net Zero Scenario, all lighting sales need to be LED technology by 2025, with higher efficacy levels by 2030. Although the trend towards LED technology is positive, governments need to continue their efforts to realise this goal.

Increasing building space and population is driving additional demand for lighting

With wealth increasing and the cost of lighting products falling, householders can afford more lighting services – especially in emerging economies. This increased demand for lighting services is also being driven by rising populations and a growing number of households and especially floorspace. Building floor area has grown by about 60% in the past two decades and is set to increase by another 20% this decade, adding a total floor surface area of nearly 45 billion m2, equivalent to about five times the floor area in Indonesia today.

These pressures are pushing up demand for lighting, highlighting the importance of deploying LED lamps in all markets to limit overall energy consumption.

LED is now the leading lighting technology in homes

Globally, residential LED sales have increased substantially in recent years, rising from around 5% of the market in 2013 to about 50% in 2022, with integrated LED luminaires (one or more lamps within a unit) making up an increasing share. A number of developed markets, including the United States and Europe, are responsible for the rapid expansion of the luminaire market, with China establishing a substantial domestic and global manufacturing base.

The efficacy of new LEDs continues to rise, though needs to increase by about 30% by 2030 to align with the Net Zero Scenario

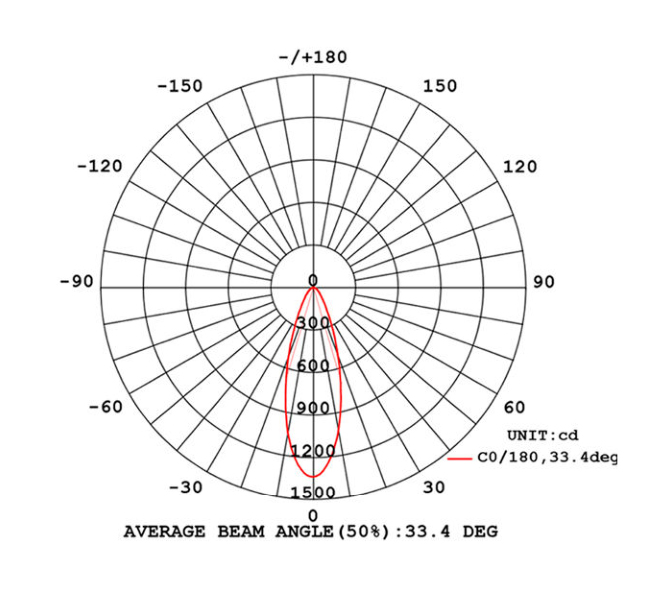

LED efficiency, or efficacy, has improved considerably in recent years. LEDs typically available in the residential market have an efficacy of over 100 lumens per watt (lm/W), depending on the model (e.g., directional, non-directional, tubular). Since 2010 the average efficacy of LEDs has improved by around 4 lm/W each year. The best-in-class technologies now achieve over 200 lm/W, but they are currently more expensive. The efficacy of new LEDs continues to rise, though needs to reach about 140 lm/W by 2030 to align with the Net Zero Scenario, which would be around 30% higher than the 2022 average.

LEDs have become more efficient than any other economically viable alternative. Further advances could be made through advanced LED modules (e.g., consisting of multiple-chip packages on a printed circuit board), for instance, or continuous improvements in optics. Direct current (DC) grids also hold the potential to reduce losses from converting alternating current (AC) to DC (as LEDs run on DC).

Minimum energy performance standards are widely employed as the key driver for efficiency improvements

Around 90 countries now use Minimum Energy Performance Standards (MEPS) and prohibit low-efficacy lighting products from the market. Almost 80% of the world’s lighting energy consumption is now covered by such standards, rising to more than 90% in Europe, the United States and China.

Mercury considerations are also limiting the use of flourescent lamps and driving higher efficacy standards. Recent regulatory requirements include:

Governments are using voluntary measures to enhance the uptake of LEDs, as well as introducing higher-quality and higher-efficacy lamps. Recent policy developments include:

International initiatives are providing capacity to support governments in developing effective lighting policy

There are some organisations and initiatives involved in facilitating international collaboration on energy-efficient electrical appliances, which also seek to improve the efficiency of lighting. These include:

We would like to thank the following external reviewers:

This report is the IEA’s primary annual analysis on global developments in energy efficiency markets and policy. It explores recent trends in energy intensity, demand and efficiency-related investment, innovation, policy and technology while also discussing key questions facing policy makers. This year record-high consumer energy bills and securing reliable access to supply are urgent political and economic imperatives for almost all governments.

Interactive database of over 550 individual technology designs and components across the whole energy system that contribute to achieving the goal of net-zero emissions

Part of Technology and innovation pathways for zero-carbon-ready buildings by 2030

The authoritative tracker of global energy efficiency trends

From “hidden fuel” to “first fuel”

Get updates on the IEA’s latest news, analysis, data and events delivered twice monthly.

Contributors Clara Camarasa Chiara Delmastro Noah Sloots Fabian Voswinkel

Governments should take advantage of the growing LED market (and lower LED costs) to raise minimum performance and quality requirements for lighting products.

In addition to updating standards, further effort is needed to expand lighting policy coverage to markets that are still unregulated, as almost one quarter of global energy use for lighting in the residential sector is not yet covered by MEPS. Phasing out incandescent, halogen and compact fluorescent lamps and setting efficacy and quality (e.g., flicker and lifetime) requirements for LED lamps is critical for general lighting applications in both developed and developing countries. Countries may consider using model lighting regulations developed by U4E.

Labelling of lighting is now mandatory in over 60 countries, covering half of the world’s lighting electricity consumption. Extending labelling to new countries and lighting products will provide consumers with information to guide their purchases, as well as allow mechanisms for governments to introduce other measures (such as targeted subsidies).

Further harmonisation of labelling is crucial to help suppliers realise economies of scale, which would raise both product affordability and the amount of capital available for investment in innovation. In addition, labelling schemes must be based on robust standards against which products can be scaled, and there should also be related policy mechanisms to ensure that the same rules apply to all market participants.

Furthermore, design regulations for lighting applications and services should be revisited. In many countries, energy performance standards for buildings (e.g., lighting energy use per square metre) have not been updated enough to reflect the rapidly changing lighting market.

These standards should recognise that LED lamps are now twice as efficient as fluorescent and are much more amenable to lighting controls (i.e., adjustment of light output and even colour using fixture sensors). Improved metrics for quality control and more appropriate testing procedures are also critical to ensure LED energy performance and quality.

Market-based solutions, such as using bulk procurement and energy service providers, can help reduce LED costs even further, whilst increasing uptake.

Governments can also increase market volumes through public procurement schemes that bring new and better lighting technologies to national markets. But standards for lighting products are needed to ensure that public buildings choose high-performance products.

Governments can also provide incentives to manufacturers for the RD&D of very high-efficiency LED technologies.

Inground Light From China Manufacturer Thank you for subscribing. You can unsubscribe at any time by clicking the link at the bottom of any IEA newsletter.